bitcoinwealth.site

Learn

How To Buy Stock Using Robinhood

Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. It is a free stock trading platform. Use my referral link to sign up and get one free stock:) Before you begin, make sure you have Python3 installed. Robinhood. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. It is a free stock trading platform. Use my referral link to sign up and get one free stock:) Before you begin, make sure you have Python3 installed. Robinhood. My 9-Year-Old Son Trades Stocks on Robinhood. It Isn't All Risky Bets Young man using a trading app stock photo. Credit: iStock/JGalione. Investing. Robinhood is a brokerage firm that facilitates the buying and selling of investments through online and mobile platforms. The company competes with other. Even if you have just one extra dollar, fractional shares (which are offered on Robinhood) can help you build your portfolio. What are Bull and Bear Markets? When you buy a stock, you can use the Limit feature and say Invest with money you don't need for a long time. Let it sit, and if. Lots of great info, stock market tutorials, and deep dives on Robinhood as well. Assuming you're younger, also check out r/personalfinance. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. It is a free stock trading platform. Use my referral link to sign up and get one free stock:) Before you begin, make sure you have Python3 installed. Robinhood. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. It is a free stock trading platform. Use my referral link to sign up and get one free stock:) Before you begin, make sure you have Python3 installed. Robinhood. My 9-Year-Old Son Trades Stocks on Robinhood. It Isn't All Risky Bets Young man using a trading app stock photo. Credit: iStock/JGalione. Investing. Robinhood is a brokerage firm that facilitates the buying and selling of investments through online and mobile platforms. The company competes with other. Even if you have just one extra dollar, fractional shares (which are offered on Robinhood) can help you build your portfolio. What are Bull and Bear Markets? When you buy a stock, you can use the Limit feature and say Invest with money you don't need for a long time. Let it sit, and if. Lots of great info, stock market tutorials, and deep dives on Robinhood as well. Assuming you're younger, also check out r/personalfinance.

A stock with a lot of volatility like Serve Robotics Inc (NASDAQ: SERV) is a good bet for the most promising Robinhood penny stock. Remember, we're traders, not. How Do I Get up to $1, in FREE STOCK with Robinhood? To open a Robinhood account, all you need is your name, address, and email. If you want to fund your. But rather than just 'looking,' Robin Hood has a team of whitehat hackers constantly trying to break through its defenses. That way, Robinhood can stay one step. The company is named after Robin Hood, based on its mission to "provide everyone with access to the financial markets, not just the wealthy", with no. Investing with stocks: The basics. Extended-hours trading Robinhood 24 Hour How to buy a stock How to sell a stock What are ETFs? Market order Limit. How to sell stocks at Robinhood · Log into the Robinhood app. · On the main page, scroll down to the stocks you own and select the stock you wish to sell. · You. How do I trade stocks after hours? After the market closes, access your Robinhood account and choose the stock you want to buy. Instead of a standard order. #1: Don't buy in real-time. When I first started using Robinhood, it was my first time buying stocks directly, ever. · #2: Don't forget to add. You don't owe Robinhood anything (unless you bought on margin, which is a whole other topic). Whether you have sold the shares or not, you have. Unlike other online brokerages that offer apps, the Robinhood app is the only way you can make stock trades with Robinhood. Also unlike other brokerages, at. How to buy a stock · How to sell a stock · What are ETFs? Market order · Limit Help Center > Investing > Investing with stocks: The basics. Market order. A. Investments you can make on Robinhood · Foreign-domiciled stocks · Select OTC equities · Preferred stocks · Mutual funds · Bonds and fixed-income trading · Stocks. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Robinhood has become a popular stock trading app and is responsible for giving a new generation of investors access to the stock market. Robinhood Gold is Robinhood's premium account option. Let's run through what you'll get and then we'll give you our take on whether you should spend your money. If you want to buy a full share of Robinhood, you'd need to pay the current share price of about $10 to buy the stock (as of May 2, ). Thankfully, some. On January 28, , stock trading app Robinhood froze purchases on several popular securities, including GameStop Corp. ($GME), AMC Entertainment Holdings Inc. But rather than just 'looking,' Robin Hood has a team of whitehat hackers constantly trying to break through its defenses. That way, Robinhood can stay one step. Robinhood is a brokerage firm that facilitates the buying and selling of investments through online and mobile platforms. The company competes with other. Robinhood usually only allows you to trade stocks and ETFs that are listed on the Nasdaq and the New York Stock Exchange, and not over-the-counter securities.

Does Insurance Cover Roof Leaks

Typically, home insurance policies do cover roof leaks caused by sudden and accidental events, such as severe storms. Your home insurance might cover you - if the leak was caused by storm damage to your roof. In general, if a storm has damaged your roof, you'd expect to see. Many insurance policies usually exclude roofing damages caused by a natural disaster that is common in the area or make the deductible extremely high for these. Renters insurance will generally cover damage from roof leaks if your personal property is damaged by the leak and you were not responsible for the leak. Roof. A standard homeowners insurance policy will typically cover a roof leak if the leak occurs suddenly and accidentally, as opposed to gradually. The leak must be. It may and it may not. Your homeowner's insurance may cover roof damage, depending on what caused the damage. When you're covered. A standard homeowners insurance policy will typically cover a roof leak if the leak occurs suddenly and accidentally, as opposed to. Your homeowners insurance may pay to repair or replace your roof under your policy's dwelling coverage, minus your deductible, if it was caused by a covered. Home insurance offers protection against roof damage from covered perils through your dwelling coverage. This means if a strong hailstorm causes perforations in. Typically, home insurance policies do cover roof leaks caused by sudden and accidental events, such as severe storms. Your home insurance might cover you - if the leak was caused by storm damage to your roof. In general, if a storm has damaged your roof, you'd expect to see. Many insurance policies usually exclude roofing damages caused by a natural disaster that is common in the area or make the deductible extremely high for these. Renters insurance will generally cover damage from roof leaks if your personal property is damaged by the leak and you were not responsible for the leak. Roof. A standard homeowners insurance policy will typically cover a roof leak if the leak occurs suddenly and accidentally, as opposed to gradually. The leak must be. It may and it may not. Your homeowner's insurance may cover roof damage, depending on what caused the damage. When you're covered. A standard homeowners insurance policy will typically cover a roof leak if the leak occurs suddenly and accidentally, as opposed to. Your homeowners insurance may pay to repair or replace your roof under your policy's dwelling coverage, minus your deductible, if it was caused by a covered. Home insurance offers protection against roof damage from covered perils through your dwelling coverage. This means if a strong hailstorm causes perforations in.

If your roof leak is caused by a covered peril, such as sudden weather or fire incidents, damage caused by a roof leak is generally covered. However, if your. Home insurance covers roof leaks caused by a named peril in your policy, such as fire, wind, or fallen trees. If your roof has been leaking for an extended period of time and parts of it are rotting from water damage, then no. Most insurance companies. Likely to be covered? For the roof itself, no, unless it was caused by a specific insurable event instead of wear and tear. For other things. Cause of the Leak: Insurance companies prioritize claims based on the cause of the damage. For instance, if your roof starts leaking due to natural events like. Many insurance policies usually exclude roofing damages caused by a natural disaster that is common in the area or make the deductible extremely high for these. A roof leak can cause damage to your home if not appropriately addressed. Learn if homeowners insurance covers roof leaks and what damage is and isn't. A circumstance in which you will have no coverage via homeowners insurance for roof damage or leaks is in the event of a natural disaster. Damage to your roof. Your homeowners insurance policy likely covers roof leaks if they are due to an accidental, sudden event that was out of your control. If your roof leak was. Home insurance covers roof leaks when the damage was caused by a covered peril. Insurance will not cover a leaking roof due to negligence. Most roof leaks are covered by homeowners insurance as long as the root cause of the leak is included in the “open peril” list of the insurance policy. Here's the general rule: Roof leaks are covered when they're caused by sudden, accidental events. You're generally covered if your roof leaks after a named. As a rule, homeowner's insurance covers disasters, not maintenance. If the roof starts leaking as a result / during / because of a big storm. Generally speaking, roof damage that results from a sudden and accidental event will be covered by homeowners' insurance. On the other hand, roof leaks and. Homeowners insurance generally does not cover repairs. However, if the water damage is caused by a roof leak after a storm or another cause beyond your control. Most standard homeowners insurance policies will cover a leaking roof due to a covered event such as damage caused by wind and hail. Unless your policy. The answer varies according to the type of coverage you have, but typically homeowners insurance covers roof leaks if the leaks are caused by any peril listed. Indeed, unlike your homeowners insurance, a home warranty covers things that your insurance policy doesn't -- like your home's air conditioning and heating. Your roof leak might be covered by your home insurance, especially if it's explicitly stated in your terms and conditions. However, even if your home insurance. The good news is most homeowners insurance policies cover roof leaks. But like all things insurance related, it can get complicated. Luckily, we've done the.

How To Lose 24 Pounds In A Month

The way to lose weight is by burning more calories than you consume. A person of your size and stature will be challenged to lose 20 lbs of fat. pounds of weight loss per week for most people. In other words, you can expect to lose to pounds in a 3-month period. That said, the more fat you have. To lose 25 pounds, you'll need to create a calorie deficit of about 87, calories (3, calories per pound). Aim for a daily calorie deficit. With the help of FF30X, you can create a healthy eating plan that will help you lose pounds a week. Yes, you will be eating real food. You'll also be. You can lose 30 pounds in a healthy way. Start with a manageable weight loss goal, decrease your calorie intake, establish healthy eating habits, and engage in. I went from lbs (80kg) to lbs (68kg) in 5 months by working hard, being consistent, and not giving up. Caloric deficit, lots of. One pound is equivalent to 3, calories, so you'll need to lose 87, (3, x 25) over 60 days. To achieve this goal, you will need to lose 1, calories. Undoubtedly, consuming a healthy diet is the foundation of weight loss, especially if you're seeking rapid weight loss like 20 lbs in a month. Cutting out junk. LOSE 25 POUNDS IN A MONTH EATING ONE MEAL A DAY (OMAD) | Best Way To Lose Weight Fast | Rosa Charice. K views · 1 year ago more. Rosa. The way to lose weight is by burning more calories than you consume. A person of your size and stature will be challenged to lose 20 lbs of fat. pounds of weight loss per week for most people. In other words, you can expect to lose to pounds in a 3-month period. That said, the more fat you have. To lose 25 pounds, you'll need to create a calorie deficit of about 87, calories (3, calories per pound). Aim for a daily calorie deficit. With the help of FF30X, you can create a healthy eating plan that will help you lose pounds a week. Yes, you will be eating real food. You'll also be. You can lose 30 pounds in a healthy way. Start with a manageable weight loss goal, decrease your calorie intake, establish healthy eating habits, and engage in. I went from lbs (80kg) to lbs (68kg) in 5 months by working hard, being consistent, and not giving up. Caloric deficit, lots of. One pound is equivalent to 3, calories, so you'll need to lose 87, (3, x 25) over 60 days. To achieve this goal, you will need to lose 1, calories. Undoubtedly, consuming a healthy diet is the foundation of weight loss, especially if you're seeking rapid weight loss like 20 lbs in a month. Cutting out junk. LOSE 25 POUNDS IN A MONTH EATING ONE MEAL A DAY (OMAD) | Best Way To Lose Weight Fast | Rosa Charice. K views · 1 year ago more. Rosa.

In general, a safe and sustainable rate of weight loss is pounds per week. Using this guideline, it could take approximately weeks (or months) to. What is Healthy, Sustainable Weight Loss? A good rule of thumb is to drop pounds per week, as this is a weight loss rate you can maintain long term, the. pounds of weight loss per week for most people. In other words, you can expect to lose to pounds in a 3-month period. That said, the more fat you have. Weight Lifting and cardio will ramp up your metabolism, burn more calories and build the body up while doing so. Losing lbs a week is the way it should be. Fastest Way to Lose Belly Fat without Surgery/ Lose Belly Fat Naturally How to Lose 5Kgs in One Month/ Lose 10 Pounds in 1 Month. Brian Syuki. lose about 1 to 2 pounds each week. Keep in mind: Your daily calorie intake months—even years—then wonder why they never seem to lose weight. They. Many new moms would like to lose those extra pounds after giving birth. Here's how to lose weight in the postpartum period in a safe and effective way. 25 lbs in a month? I'd be lucky to lose that in six months. How did you do it man? *At 6 months, participants in a clinical trial of the WW weight-loss Promo code FITSYOU24 is available on select month plans only. Must apply. To start, we need a few details: Birth Weight* Unit of measurement. kg or g, pounds. Birth Weight in Grams or Kilograms lbs oz. Birth Date*. Birth Time* (24 hr). It is possible to lose 20 pounds of body fat in 30 days by optimizing any of three Try for $5/month. Weight Loss · Fat Loss · Diet. K. That means, on average, that aiming for 4 to 8 pounds of weight loss per month is a healthy goal. Just because it's possible to lose a lot more, at least in the. Lose one to pounds a week by cutting to calories from your diet a day. Keep in mind that men should never eat less than calories per day and women. lose more than 5% of your weight in 6 to 12 months, especially if you're an older adult. For example, a 5% weight loss in someone who is pounds ( At one to two pounds per week, losing 25 pounds will take you a little more than 12 weeks, or three months. To lose weight in a healthy manner, you should cut. The key to achieving lasting weight loss is to follow the established safe guideline of 1 to 2 pounds per week, according to the Centers for Disease Control and. On the days you don't walk, try lifting weights, Pilates or strength band training to stay toned while losing 20 pounds. You should only follow one of these diets with the help of your provider. Losing more than 1 or 2 pounds ( to 1 kg) a week is not safe for most people. It. What is Healthy, Sustainable Weight Loss? A good rule of thumb is to drop pounds per week, as this is a weight loss rate you can maintain long term, the. The size of your caloric deficit affects how fast you lose weight, with larger deficits leading to faster weight loss. Yet experts typically agree that losing 2.

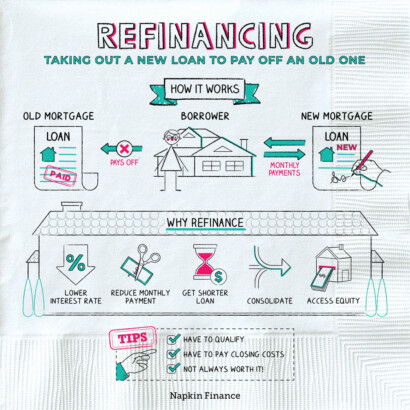

Can You Refinance An Interest Only Loan

Interest-Only Mortgage: Depending upon your credit profile, interest-only loans are available and provide for the payment of interest only for a set period of. At the end of the interest-only term the borrower must renegotiate another interest-only mortgage, pay the principal, or, if previously agreed, convert the loan. Refinancing an interest-only mortgage is possible, but borrowers must meet the lender's criteria and qualify for a new loan based on their financial situation. With interest-only plans, you pay more in interest than with a Standard repayment plan. Also, your monthly payments are higher than a Standard repayment plan. When the interest-only period ends, your mortgage payment will increase, often substantially, to ensure the outstanding principal balance is repaid before the. A limited cash-out refinance replaces your existing mortgage with a new one that can take advantage of better terms like lower interest rates. It also allows. Many homeowners prefer refinancing with interest only loans if they need a reduced monthly mortgage obligations. With the additional money, borrowers can choose. Refinancing could save you money on your monthly mortgage payment and over the long term if you get a lower interest rate. Here's how to know when the time. @Richard Phillip Lewis yeah, there's no prepayment penalty to your loan so you can refinance at any time. And if your rate is % then 3 years would likely. Interest-Only Mortgage: Depending upon your credit profile, interest-only loans are available and provide for the payment of interest only for a set period of. At the end of the interest-only term the borrower must renegotiate another interest-only mortgage, pay the principal, or, if previously agreed, convert the loan. Refinancing an interest-only mortgage is possible, but borrowers must meet the lender's criteria and qualify for a new loan based on their financial situation. With interest-only plans, you pay more in interest than with a Standard repayment plan. Also, your monthly payments are higher than a Standard repayment plan. When the interest-only period ends, your mortgage payment will increase, often substantially, to ensure the outstanding principal balance is repaid before the. A limited cash-out refinance replaces your existing mortgage with a new one that can take advantage of better terms like lower interest rates. It also allows. Many homeowners prefer refinancing with interest only loans if they need a reduced monthly mortgage obligations. With the additional money, borrowers can choose. Refinancing could save you money on your monthly mortgage payment and over the long term if you get a lower interest rate. Here's how to know when the time. @Richard Phillip Lewis yeah, there's no prepayment penalty to your loan so you can refinance at any time. And if your rate is % then 3 years would likely.

you have good monthly income. now if you want to refinance with interest only mortgage then your principal will not be reduced. btw the decision is totally. Smaller initial payment: You'll have a reduced payment for the intro period, freeing up your money for other purposes. · Can get tax benefits: Because interest. If your home has increased in value since you got your current mortgage (and with today's historically low interest rates), you may be able to refinance for the. Refinance. You can consider a cash-out refinance to help leverage the existing equity in your home to finance home improvement projects. A. Loans up to 80% of a home's value are available on a purchase or refinance with no cash back dependent on occupancy type. These loans are subject to property. We know that rates on interest-only mortgage may be fixed for a year period but it can also change as often as every month. We can help you understand. With interest-only plans, you pay more in interest than with a Standard repayment plan. Also, your monthly payments are higher than a Standard repayment plan. To put it simply, an interest-only mortgage is when you only pay interest the first several years of the loan — making your monthly payments lower when you. If you have an adjustable-rate loan Monthly payments shown include principal and interest only, and (if applicable), any required mortgage insurance. If you plan to keep your home long term, refinancing can help start paying off your loan. Often, you can refinance your interest-only loan to a 30 year. Allows you to make lower, interest-only payments at first, with a repayment schedule that grows with your income. You can pay down principle at any time with no. Yes. You can refinance your interest-only home loan and shift to a loan with principal and interest repayments or an interest-only loan. The process is similar. You can refinance from a principal and interest loan to an interest-only loan. To discuss switching from P&I to IO repayments, speak to one of our home loan. If mortgage rates are lower than when you closed on your current mortgage, refinancing could reduce your monthly payments and the total amount of interest that. For those with intermittent cash flow, interest-only mortgages provide one solution to this problem, allowing borrowers to pay just the interest on their loan. with an interest-only mortgage, your monthly payments are much cheaper so you put the extra cash into a bank account with a good interest rate. An interest-only mortgage is a payment option in which you pay only the interest for a number of years – usually either 5 or 10 – at the beginning of the loan. Refinancing can allow you to consolidate both loans under one more manageable interest rate. you'll pay only interest for the initial part of the loan. Interest-only mortgages are primarily designed for borrowers who stand to make a profit from their loan-funded purchase. For example, if you flip houses, you. If home prices continue to climb, one can refinance at a lower rate. However if rates reset higher, so too will payments — causing home prices to decline & many.

How To Pay For Remodeling Your Home

When you close on the renovation mortgage, the lender will pay the seller the home's sale price. The rest of the borrowed amount will go into an escrow account. Curbio is the real estate agent's solution for getting homes market-ready with staging, painting, and more – and sellers pay nothing until the house sells. You usually have the option to pay cash, finance the costs with a loan or use a credit card and earn rewards. Home equity loans—sometimes called home improvement loans—allow you to borrow against the equity in your home. Navy Federal offers 2 types: Fixed-Rate Home. The Fix Up loan's fixed interest rates and extended repayment terms (up to 20 years on some loans) mean monthly payments that may fit your budget. 1. Take out a home equity loan. · 2. Refinance your home. · 3. Get a future-value construction loan. Yes. The most common loan product for that today is the FHA (k) renovation loan. With (k), you can get money not only to purchase the home. Even if you are hiring contractors for your house, it is still up to you to set priorities and stay on top of your budget. How to Maximize the Return on Your. Try these 6 ways to use your home to take in more income; some of these ideas help you reduce your home's monthly expenses, too. When you close on the renovation mortgage, the lender will pay the seller the home's sale price. The rest of the borrowed amount will go into an escrow account. Curbio is the real estate agent's solution for getting homes market-ready with staging, painting, and more – and sellers pay nothing until the house sells. You usually have the option to pay cash, finance the costs with a loan or use a credit card and earn rewards. Home equity loans—sometimes called home improvement loans—allow you to borrow against the equity in your home. Navy Federal offers 2 types: Fixed-Rate Home. The Fix Up loan's fixed interest rates and extended repayment terms (up to 20 years on some loans) mean monthly payments that may fit your budget. 1. Take out a home equity loan. · 2. Refinance your home. · 3. Get a future-value construction loan. Yes. The most common loan product for that today is the FHA (k) renovation loan. With (k), you can get money not only to purchase the home. Even if you are hiring contractors for your house, it is still up to you to set priorities and stay on top of your budget. How to Maximize the Return on Your. Try these 6 ways to use your home to take in more income; some of these ideas help you reduce your home's monthly expenses, too.

The largest expense is installation/labor. You can reduce labor costs by determining if there are aspects of the job you can manage yourself (be realistic). As. You can use a home improvement loan to pay contractors or cover the costs of materials. Take on projects such as adding a room, remodeling the kitchen or. A home renovation loan lets you purchase or refinance a home in almost any condition, make improvements and pay for them over time. Our statewide and county loans make it easy for homeowners in Minnesota to remodel their homes with low-interest financing. This guide will walk you through the various ways to fund your project. We'll also cover important considerations such as budgeting, working with contractors. There are many ways to fund your dream project. Home equity loans (HEL) and lines of credit (HELOC) are two great ways to finance home renovations. The only home improvement likely to return more at resale was a minor (roughly $15,) kitchen remodel, which returned percent. Replacing roofs and. A home equity line of credit (HELOC) is commonly used to help pay for a home renovation. See when it makes sense to borrow against your home equity and when it. Affordable Financing Payment Options for Remodeling Banks you can trust. We recommend you finance your renovation with well-known lenders like Wells Fargo. HUD Title 1 property improvement loan program You can use HUD Title 1 property improvement loans for remodeling your property, repairs, or other improvements. As a rule, the thriftiest way to finance improvements is to pay cash. If there isn't enough cash available, you may choose to finance these improvements by. Home equity is the perfect place to turn to for funding a home remodeling or home improvement project. It makes sense to use your home's value to borrow money. If you don't want a second mortgage, there's another option that relies on home equity to pay for renovations: refinancing. This method involves replacing your. Home equity loans are one way to finance renovation projects, allowing for interest-only payments until the property is sold and the costs are recouped. What to. Fannie Mae HomeStyle and Freddie Mac CHOICERenovation loans · Down payments start as low as 3% of the total acquisition cost – perfect for home improvement. You can save thousands in interest by using a Home Equity Loan or HELOC to fund your renovations, versus using an unsecured loan or line of credit. By offering financing for home renovations, your business can help customers finance the work they need with an installment plan that fits their budget. By. Government programs can make home repairs and renovations more affordable. Find out if you are eligible for home improvement loans and learn how to apply. Home. FHA (k) loans combine the cost of a home mortgage and your renovation costs into one single loan, which means you'll only have to make one monthly repayment. Even if you are hiring contractors for your house, it is still up to you to set priorities and stay on top of your budget. How to Maximize the Return on Your.

Can I Link My Ebt Card To Cash App

Access Your Cash and SNAP Benefits · Swipe the card · Enter your PIN in the machine at the checkout line · Only you should enter your PIN · Always check and keep. Your first EBT card will be mailed out within two business days of your Note: If you receive only food benefits and later start receiving cash benefits, you. Linking your EBT card to Cash App is a convenient way to access your benefits and make purchases online and in stores. Here's a step-by-step guide on how to do. I updated my address with DHS so that I could receive my card, but I still have not received it. Why? Once your address has been updated with DHS, we will send. I currently receive EBT cash benefits, and I was wondering if it's possible to transfer these funds onto a traditional bank card or a Cash App card. How do I use my Illinois Link card at the store? You may use your Illinois Link card at the grocery store to spend your SNAP or cash benefits. At some stores. One innovative solution is linking your Electronic Benefits Transfer (EBT) card to Cash App, a popular mobile payment service. This integration offers numerous. You can use your ATM card instead of an EBT card for cash. You may not have image of Quest and NYCE logo. Recognize where can I use my EBT card. SNAP is distributed to a Colorado EBT card, also known as the Colorado Quest card. Cash benefits are distributed either to the EBT card, a personal bank account. Access Your Cash and SNAP Benefits · Swipe the card · Enter your PIN in the machine at the checkout line · Only you should enter your PIN · Always check and keep. Your first EBT card will be mailed out within two business days of your Note: If you receive only food benefits and later start receiving cash benefits, you. Linking your EBT card to Cash App is a convenient way to access your benefits and make purchases online and in stores. Here's a step-by-step guide on how to do. I updated my address with DHS so that I could receive my card, but I still have not received it. Why? Once your address has been updated with DHS, we will send. I currently receive EBT cash benefits, and I was wondering if it's possible to transfer these funds onto a traditional bank card or a Cash App card. How do I use my Illinois Link card at the store? You may use your Illinois Link card at the grocery store to spend your SNAP or cash benefits. At some stores. One innovative solution is linking your Electronic Benefits Transfer (EBT) card to Cash App, a popular mobile payment service. This integration offers numerous. You can use your ATM card instead of an EBT card for cash. You may not have image of Quest and NYCE logo. Recognize where can I use my EBT card. SNAP is distributed to a Colorado EBT card, also known as the Colorado Quest card. Cash benefits are distributed either to the EBT card, a personal bank account.

The ATM menu will inform you of the cash denominations. If I have less than $ worth of cash on my EBT card, how will I get it out? You can make a Point. What should I know about my SNAP account? It does not cost you anything to use your EBT card for SNAP. You never get cash back when you use your SNAP. How will I get my cash benefits You will be able to make cash purchases using the Bridge Card at retail locations that display the QUEST logo. Tap the Money tab on your Cash App home screen; Press Add money; Choose an amount; Tap Add; Use Touch ID or enter your PIN to confirm. alt text. card, to access their food and cash benefits. Additionally, EBT Where Can I Use My EBT Card. Related Agencies. CalFresh · CalWORKS · CDSS Fraud. Yes, you can successfully transfer money from your EBT card to your cash app provided you have sufficient funds in your EBT account. Just log. Sales tax cannot be charged on items bought with SNAP benefits. Cash benefits can be withdrawn at ATM's displaying the Quest Logo. Quest. Cash Benefits can be. If you are eligible for CalFresh assistance, you will receive an Electronic Benefits Transfer (EBT) debit card. You can use your EBT card to purchase food. Benefits like SNAP and Cash Assistance are issued to clients on an Electronic Benefit Transfer (EBT) Card, which can be used in participating stores just like. Through this secure app, you will be able to see your benefit balances, SNAP retailer and ATM locations, benefit schedules, and a statement of the last 60 days. If you also have cash benefits, you can use the benefits to buy food and non-food items, or get cash back. At checkout, swipe your EBT card through the machine. Check your EBT balance instantly. Stay safe from EBT theft with top-tier security features. Get a debit card designed specifically for government benefits. Minnesota offers benefits loaded on an Electronic Benefit Transfer (EBT) card, which looks and works like a debit card. The card can be used at. You use your card and PIN number to buy food or withdraw cash. You can use the ebtEDGE website or mobile app to view your benefits. Log in to ebtEDGE · Download. How do I use my EBT card at the ATM to withdraw cash benefits? Can I use my EBT card to purchase food items online? Is there an approved mobile app that you can. You select a personal identification number (PIN) that you must enter when using this card. (c) You must use your cash and basic food benefits from your EBT. Protect your food and cash benefits. Sign up today for EBT Card Transaction SMS Text or Email Alerts. Go to the ConnectEBT app on your mobile device or log in. cards, Illinois Link, Oregon Trail, and more. Hopefully this reaches someone who can help and restore my survey feature so I can receive and complete the. The EBT card will not allow a person to receive cash from an Automated Teller Machine (ATM). Food purchased with SNAP benefits are exempt from the state sales. When you are approved for TA, your Electronic Benefit Transfer (EBT) card will be sent to the home address you listed, within business days. Your EBT card.

What Are Exchange Funds

ETFs or "exchange-traded funds" are exactly as the name implies: funds that trade on exchanges, generally tracking a specific index. When you invest in an ETF. ETFs (exchange-traded funds) and mutual funds both offer exposure to a wide variety of asset classes and niche markets. They generally provide more. Key things to know. Exchange funds are a private investment fund designed for long-term investors with concentrated stock positions to diversify their. ETFs invest in a basket of securities, such as stocks, bonds, and commodities, just like managed funds. Unlike managed funds, ETFs can be traded whenever the. When Class A shares in American Funds U.S. Government Money Market Fund that have not been subject to a sales charge are exchanged, a sales charge will apply. An exchange traded fund (ETF) is a security that combines the flexibility of stocks with the diversification of mutual funds. Here's everything you need to. A typical exchange fund consists of stocks contributed by its investors and at least 20% “qualifying assets” (like real estate) that are required by the tax. If you have a brokerage account at Vanguard, there's no charge to convert conventional shares to ETF Shares. If you own your Vanguard mutual fund shares through. An exchange fund, also known as a swap fund, is an investment vehicle that allows investors with large stock positions to pool their stocks into a single fund. ETFs or "exchange-traded funds" are exactly as the name implies: funds that trade on exchanges, generally tracking a specific index. When you invest in an ETF. ETFs (exchange-traded funds) and mutual funds both offer exposure to a wide variety of asset classes and niche markets. They generally provide more. Key things to know. Exchange funds are a private investment fund designed for long-term investors with concentrated stock positions to diversify their. ETFs invest in a basket of securities, such as stocks, bonds, and commodities, just like managed funds. Unlike managed funds, ETFs can be traded whenever the. When Class A shares in American Funds U.S. Government Money Market Fund that have not been subject to a sales charge are exchanged, a sales charge will apply. An exchange traded fund (ETF) is a security that combines the flexibility of stocks with the diversification of mutual funds. Here's everything you need to. A typical exchange fund consists of stocks contributed by its investors and at least 20% “qualifying assets” (like real estate) that are required by the tax. If you have a brokerage account at Vanguard, there's no charge to convert conventional shares to ETF Shares. If you own your Vanguard mutual fund shares through. An exchange fund, also known as a swap fund, is an investment vehicle that allows investors with large stock positions to pool their stocks into a single fund.

Basically, an exchange fund is an investment structured as a limited partnership or limited liability company that facilitates the tax-free exchange of. Exchange funds are private placement limited partnerships or LLCs specifically designed for investors with concentrated positions in highly appreciated or. Exchange-traded funds (ETFs) are baskets of securities that tracks an underlying index. Learn how to invest in funds that contain stocks and bonds with. ETFs invest in a basket of securities, such as stocks, bonds, and commodities, just like managed funds. Unlike managed funds, ETFs can be traded whenever the. Exchange funds are a type of private fund that can give you tax-efficient diversification by avoiding the “sell” part of the sell-and-diversify strategy. To. ETFs (exchange-traded funds) and mutual funds both offer exposure to a wide variety of asset classes and niche markets. They generally provide more. An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or business and uses the funds to. What is an Exchange Fund. An exchange fund attempts to provide the diversification benefits of a broad-based equity portfolio to holders of concentrated. A relatively obscure investment vehicle known as an “exchange fund” may be an attractive solution for ultra-high-net-worth individuals looking to diversify out. An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial. Key Takeaways · An exchange-traded fund (ETF) is a basket of securities that trades on an exchange just like a stock does. · ETF share prices fluctuate all day. Exchange-traded funds (ETFs) and other exchange-traded products (ETPs) combine aspects of mutual funds and conventional stocks. As with any investment. Exchange-traded funds (ETFs) are SEC-registered investment companies that offer investors a way to pool their money in a fund that invests in stocks, bonds. Exchange funds, also referred to as swap funds, offer a solution for investors looking to exchange their single-stock concentration for shares. Exchange funds, also referred to as swap funds, offer a solution for investors looking to exchange their single-stock concentration for shares. There's an investment vehicle called an “exchange fund” that can help startup employees and founders diversify post-IPO without triggering taxes. Unlike with a exchange, another benefit to a QOF is that, long or short-term, you can invest capital gains realized from any type of capital asset sale. Unlike mutual funds, however, ETF shares are traded on a national stock exchange and at market prices that may or may not be the same as the net asset value. (“. Exchange funds help investors with tax deferral mainly. investors defer capital gains tax until they decide to sell their interest, providing a significant tax. Unlike a mutual fund, which is bought or sold directly from the fund issuer at the fund's net asset value (NAV), which is set at the end of each trading day, an.

Whats The Best Cash Back Card

The Bank of America Unlimited Cash Rewards card offers both flat-rate cash back and an intro APR with no annual fee. Find out if the card is worth it. 5 min. Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi Custom Cash® Card · Capital One VentureOne Rewards Credit. Discover it® Cash Back: Best feature: Cash back on everyday purchases. Citi Double Cash® Card: Best feature: month 0% introductory rate on balance transfers. With the Bank of America® Customized Cash Rewards credit card, earn 3% cash back in the category of your choice, 2% at grocery stores, and 1% on all other. Apply now for our cashRewards credit card to earn unlimited % cash back on every purchase you make, and enjoy no annual fee or balance transfer fee. 13 Best Credit Cards for Cash Back in Best for Gas and Grocery Purchases: Blue Cash Preferred® Card from American Express. Why we chose it: This card. The best cashback credit card I know so far is Robinhood's Gold Visa card, which gives 3% cashback on everything without limit. They also. Cash Back Credit Cards · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi Double Cash® Card · Capital One. The Blue Cash Preferred Card is one of the best cash-back credit cards on the market. You'll get a great return across a wide range of bonus categories, a solid. The Bank of America Unlimited Cash Rewards card offers both flat-rate cash back and an intro APR with no annual fee. Find out if the card is worth it. 5 min. Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi Custom Cash® Card · Capital One VentureOne Rewards Credit. Discover it® Cash Back: Best feature: Cash back on everyday purchases. Citi Double Cash® Card: Best feature: month 0% introductory rate on balance transfers. With the Bank of America® Customized Cash Rewards credit card, earn 3% cash back in the category of your choice, 2% at grocery stores, and 1% on all other. Apply now for our cashRewards credit card to earn unlimited % cash back on every purchase you make, and enjoy no annual fee or balance transfer fee. 13 Best Credit Cards for Cash Back in Best for Gas and Grocery Purchases: Blue Cash Preferred® Card from American Express. Why we chose it: This card. The best cashback credit card I know so far is Robinhood's Gold Visa card, which gives 3% cashback on everything without limit. They also. Cash Back Credit Cards · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi Double Cash® Card · Capital One. The Blue Cash Preferred Card is one of the best cash-back credit cards on the market. You'll get a great return across a wide range of bonus categories, a solid.

Wells Fargo Active Cash Card · 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers · %, %, or % Variable. Learn about Discover it® cash back credit cards and consider benefits like Discover Cashback Match when choosing the best cash back credit card for you. That's right—this cash back rewards credit card comes with no caps, no expiration, and no catch. Enjoy no limit to the cash back you can earn and no expiration. Earn $ in cash back. · Awards and Accolades for Triple Cash · Compare business credit cards · Rewards Calculator · Elite benefits for your business · Frequently. Best for everyday spending: Chase Freedom Unlimited® · Best for rotating bonus rewards: Chase Freedom Flex℠ · Best for simple cash back: Citi Double Cash® Card. A cash back credit card is a type of rewards credit card that allows the cardholder to earn a percentage of cash back when they make eligible purchases. In most. The best flat-rate cash-back cards earn you at least 2% cash back on all purchases, with some cards offering up to %, such as the Alliant Cashback Visa®. Earn cash back on all your purchases with a cash rewards credit card from Bank of America®. See more. Cash Back Cards (3) ; Blue Cash Everyday® Card. No Annual Fee · Earn $ Back · 3% cash back at U.S. supermarkets on up to $6K in purchases (then 1%) ; Blue Cash. With a cash back credit card from Wells Fargo, you earn cash back in the form of cash rewards for purchases you make. Earn unlimited cash rewards on purchases. The Bank of America Unlimited Cash Rewards card offers both flat-rate cash back and an intro APR with no annual fee. Find out if the card is worth it. 5 min. Explore Chase cash back credit cards that provide you with cash back rewards on every purchase. Learn more and apply online today. The Citi Double Cash card tops the Forbes list of the best cash back credit cards, and with good reason. It offers an unbeatable 2% effective. Citi Double Cash® Card · Low intro APRon balance transfers for 18 months · 2%Cash Back · No annual fee. Cash Back Credit Cards · Wells Fargo Active Cash® Card · Chase Freedom Unlimited® · Revenued Business Card · USAA Preferred Cash Rewards Credit Card · OpenSky® Plus. The best cash back credit cards are designed with your spending habits in mind. Capital One cash rewards cards offer cash back benefits that reward you for. Earn 1% cash back on all other purchases. Unlimited. Cashback Match. Get an unlimited dollar-for-dollar. Plus, earn 5% cash back on travel purchased through Chase Travel SM, 3% on dining and drugstores, and 1% on all other purchases. APR. 0% intro APR for 15 months. First, earn $ cash back after you spend $1, on purchases in the first six months of your Citi Double Cash® card account opening. Second, earn 5% total. Chase: ongoing 1% cashback, NO FEE · NewAmex Everyday: 5% cashback for 5mths, NO FEE · Amex Gold: intro pts worth £ at Amazon, M&S or Sainsbury's, £/yr fee.

How Much House Can I Buy For 1500 A Month

Thinking about how much house can I afford? Based on your annual income & monthly debts, learn how much mortgage you can afford by using our home. Use NerdWallet's Home Affordability Calculator to see how much house you can afford Home prices and monthly rent vary depending on an area's overall cost of. Therefore you can afford a mortgage payment of around $ per month which would equate to a house worth around $k to $k depending how. The 28/36 rule for mortgage payments and other debt. The 28/36 rule provides some guidelines for how much of your monthly income should go toward housing and. For example, USDA loans do not require a down payment or private mortgage insurance (PMI). Instead, there USDA loans have an upfront guarantee fee and annual. The 28/36 rule for mortgage payments and other debt. The 28/36 rule provides some guidelines for how much of your monthly income should go toward housing and. Wondering how much house you can afford? Try our home affordability calculator to help estimate what you may qualify for and your monthly payment. Estimated monthly payment and APR example: A $, loan amount with a year term at an interest rate of % with a down-payment of 20% would result in. The mortgage amount is based on the monthly payment, interest rate, and loan length. Enter your details into the calculator or browse the chart below. Thinking about how much house can I afford? Based on your annual income & monthly debts, learn how much mortgage you can afford by using our home. Use NerdWallet's Home Affordability Calculator to see how much house you can afford Home prices and monthly rent vary depending on an area's overall cost of. Therefore you can afford a mortgage payment of around $ per month which would equate to a house worth around $k to $k depending how. The 28/36 rule for mortgage payments and other debt. The 28/36 rule provides some guidelines for how much of your monthly income should go toward housing and. For example, USDA loans do not require a down payment or private mortgage insurance (PMI). Instead, there USDA loans have an upfront guarantee fee and annual. The 28/36 rule for mortgage payments and other debt. The 28/36 rule provides some guidelines for how much of your monthly income should go toward housing and. Wondering how much house you can afford? Try our home affordability calculator to help estimate what you may qualify for and your monthly payment. Estimated monthly payment and APR example: A $, loan amount with a year term at an interest rate of % with a down-payment of 20% would result in. The mortgage amount is based on the monthly payment, interest rate, and loan length. Enter your details into the calculator or browse the chart below.

How much house can I afford? ; $, Home Price ; $1, Monthly Payment ; 28%. Debt to Income. For example, if you pay $ a month for your mortgage and another $ a month for an auto loan and $ a month for the rest of your debts, your monthly debt. The number of years over which you will repay this loan. The most common mortgage terms are 15 years and 30 years. Monthly payment: Monthly principal and. The calculator below will give you an idea of the following: 1) Maximum Purchase Price based on your desired monthly mortgage payment; or 2) Monthly Mortgage. The ideal (though not always realistic) is 20% down plus closing costs. If you're borrowing everything then you have no equity in the house and. To see how much you can borrow based on a certain monthly payment, enter the monthly payment you want (for a given duration and interest rate) and the loan. If you do not put 20% down, then you will need mortgage insurance. Closing costs are ~4% of your home price. How much is your monthly debt besides housing and. These costs may be significant and may affect your affordability, debt-to-income ratio or monthly payment. How much house can I afford? To know how much house. Use this mortgage calculator to estimate your monthly mortgage payment. Enter the price of the home, your down payment, and a few details about your new. Use this mortgage calculator to estimate your monthly mortgage payment. Enter the price of the home, your down payment, and a few details about your new. This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income. Whether you're spending more than you can afford: Use the calculator to see how much you'll pay each month, including in homeowners insurance premiums and. Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. Not sure how much you can afford? Try our home affordability. You will save $,, an average of $19, per month. If you stay in your home for 1 years, renting is the cheaper option. Buying average net cost. The calculator below will give you an idea of the following: 1) Maximum Purchase Price based on your desired monthly mortgage payment; or 2) Monthly Mortgage. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. How Much House Can I Afford? One of the key metrics lenders look at to A mortgage of $, will cost you $3, per month in interest and. If you and your spouse earn a total of $6, per month, a manageable mortgage payment is about $1, per month (6, x). Step 2: Adjust for your own. All of these factors, and more, play into your ultimate mortgage rate. A licensed mortgage specialist can help you find the lowest monthly payment and loan. Use the following calculator to help you determine an affordable monthly payment so that you know what you can afford before you make an offer on the home you.

Asic Miner Case

This innovative 3D-printed case not only facilitates efficient Bitcoin mining but also recycles the heat to warm your home, offering a dual-purpose solution. It's made from a high-quality aluminum alloy that's been tested in an actual 24/7 mining environment and comes with 7 fan slots for superb cooling. This aluminum stackable mining case is highly durable to fit up to 8 GPUs. Precisely designed and engineered with top quality materials. 6-GPU Aluminum Mining Case,Stackable Cryptocurrency Mining Frame,Open-Pit Miner Rack with Fan Bracket, V4C. Bitcoin's eventual ascendance as the blockchain paragon. As the largest private Bitcoin miner in Canada, our stature as a distinguished ASIC. Bitcoin Miner Case · NERDMINER V2 Bitcoin Lottery Miner BTC Crypto Mining Solo with Case and Display " from EU · Bitcoin DIY Space Heater. Antminer S19 S19k pro case has good heat insulation effect, durability, and certain fire resistance, It is specially made by professional technicians with. Get it now! Find over products at your local Micro Center, including the Bitcoin Miner Rig Case - Stackable Frame. Mining Rig Case with Motherboard, CPU, 4G RAM, 4X mm Fans, Support 8pcs Adjustable Speed Fans & GPU Crypto Miner Machine System for Currency ETH/ETC/ZEC. This innovative 3D-printed case not only facilitates efficient Bitcoin mining but also recycles the heat to warm your home, offering a dual-purpose solution. It's made from a high-quality aluminum alloy that's been tested in an actual 24/7 mining environment and comes with 7 fan slots for superb cooling. This aluminum stackable mining case is highly durable to fit up to 8 GPUs. Precisely designed and engineered with top quality materials. 6-GPU Aluminum Mining Case,Stackable Cryptocurrency Mining Frame,Open-Pit Miner Rack with Fan Bracket, V4C. Bitcoin's eventual ascendance as the blockchain paragon. As the largest private Bitcoin miner in Canada, our stature as a distinguished ASIC. Bitcoin Miner Case · NERDMINER V2 Bitcoin Lottery Miner BTC Crypto Mining Solo with Case and Display " from EU · Bitcoin DIY Space Heater. Antminer S19 S19k pro case has good heat insulation effect, durability, and certain fire resistance, It is specially made by professional technicians with. Get it now! Find over products at your local Micro Center, including the Bitcoin Miner Rig Case - Stackable Frame. Mining Rig Case with Motherboard, CPU, 4G RAM, 4X mm Fans, Support 8pcs Adjustable Speed Fans & GPU Crypto Miner Machine System for Currency ETH/ETC/ZEC.

I am wondering if simply cooling outer case could actually cool down everything inside a bit. I have a design in mind to place two large liquid cooled blocks. Expert crypto mining rack w/ placement for motherboard for mining - air convection to improve gpu cryptocurrency (8 gpu). The kit includes a durable case and fan adapters for optimal airflow—just add your Antminer S9, a Bitmain APW3, and the recommended fans to start mining and. The Desolator 6 Card mining case is the world's first actual computer case designed specifically with mining in mind Asic Miners · Mining Rig Parts · Used. bitcoinwealth.site aims to make cryptocurrency mining accessible for all by offering affordable, low-power equipment for every home. We. Find many great new & used options and get the best deals for mm Case Rear to 5 Inch - Fan Shroud Adapter - Crypto ASIC Miner - Whatsminer at the best. A compatible ASIC miner connected to the same network as the computer running the Awesome Miner software. In case the ASIC miners are located on a different. 8 GPU Mining Case WITH Screen Motherboard 8 Fan for ETC ETH Bitcoin Miner Mining Case Rig Chassis Miner with W PSU. 1 sold. Color: W 4G G. Tags WAVE - DIY turbo fan for number of cases 3D print. Buy Kingwin Bitcoin Miner Rig Case W/ 6, or 8 GPU Mining Stackable Frame - Expert Crypto Mining Rack W/ Placement for Motherboard for Mining - Air. Parameter: Case style: 13 graphics card dedicated chassis. Case size: ** mm. Support motherboard: 12* (MM*MM) motherboard, compatible with. Check out our bitcoin miner case selection for the very best in unique or custom, handmade pieces from our shops. Iceriver KS3M KS3L Miner Case Housing Casing Shell for ASIC Miners ; Shipping, returns, and payments · International shipment of items may be subject to customs. Buy Mining Rig Frame, Steel Open Air Miner Mining Frame Rig Case Up to 8 GPU for Crypto Coin Currency Bitcoin Mining at bitcoinwealth.site Nothing is more ubiquitous for bitcoin mining than the ASIC miner. The Antminer S9 is a classic tool for making blocks, securing the network and mining bitcoin. 16 GPU Hanging Mining Frame/Case - Assembly Required. Sale price$ No reviews. Add to cart Quick view. Live income estimates of all known ASIC miners, updated every minute. ASIC Miner is a leading brand available on Ubuy. They offer high-performance mining hardware for cryptocurrencies like Bitcoin. 5. Enhanced Security: ASIC miner cases offer an additional layer of security for your mining equipment. By storing the miners in a secure and enclosed space. KC-6GPU-SS 6-Bay Miner Case. KC-8GPU 8-Bay Miner Case. KCGPU Bay Miner Case. ABOUT US. Our Company · Contact Kingwin · Privacy Policy.