bitcoinwealth.site

Community

Purchasing Tesla Stock

How to buy Tesla (TSLA) stock from Canada · Step 1: Open a trading account with a broker · Step 2: Transfer funds to your trading account · Step 3: Decide your. Tesla has created massive wealth for shareholders since its IPO, and might have game-changing upside potential, according to this Wall Street investor. Tesla's shares trade on the NASDAQ exchange, under the ticker symbol TSLA. To purchase shares, you will need to do so through a broker. If you do not have a. Buy Tesla stock in 5 easy steps, view past price performance and learn what's ahead for the company. Car buying in general is down — interest rates are going to remain higher for longer too. When people do buy cars, it seems EVs are not their. I wanted to share my thoughts on whether to buy, sell, or keep holding Tesla stock. The share price has risen meteorically. Since reaching a record-high, it. TSLA | Complete Tesla Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. To buy fractional shares of Tesla stock, you'll need to sign up for Stash and open a personal portfolio. Stash allows you to purchase smaller pieces of. On eToro, you can buy $TSLA or other stocks and pay ZERO commission! Follow Tesla Motors, Inc. share price and get more information. Terms apply. How to buy Tesla (TSLA) stock from Canada · Step 1: Open a trading account with a broker · Step 2: Transfer funds to your trading account · Step 3: Decide your. Tesla has created massive wealth for shareholders since its IPO, and might have game-changing upside potential, according to this Wall Street investor. Tesla's shares trade on the NASDAQ exchange, under the ticker symbol TSLA. To purchase shares, you will need to do so through a broker. If you do not have a. Buy Tesla stock in 5 easy steps, view past price performance and learn what's ahead for the company. Car buying in general is down — interest rates are going to remain higher for longer too. When people do buy cars, it seems EVs are not their. I wanted to share my thoughts on whether to buy, sell, or keep holding Tesla stock. The share price has risen meteorically. Since reaching a record-high, it. TSLA | Complete Tesla Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. To buy fractional shares of Tesla stock, you'll need to sign up for Stash and open a personal portfolio. Stash allows you to purchase smaller pieces of. On eToro, you can buy $TSLA or other stocks and pay ZERO commission! Follow Tesla Motors, Inc. share price and get more information. Terms apply.

Depending on what state you live in, you can choose to lease the vehicle, purchase with financing or purchase outright. You may also be able to trade in your. The current price of TSLA is USD — it has increased by % in the past 24 hours. Watch Tesla stock price performance more closely on the chart. We accept passenger cars, trucks, vans and SUVs for trade in towards the purchase of a new or used Tesla vehicle. We outline the most cost-effective, secure and user-friendly platforms for anyone wanting to buy Tesla shares. How to buy Tesla shares (TSLA) · Step 1: Choose a broker · Step 2: Decide how much to invest · Step 3: Review TSLA stock performance and potential · Step 4. Before investing in Tesla, read here to understand its core business, company history and relevant news developments. Get Tesla Inc (TSLA:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Quick - easy way to buy one share of Tesla stock as a gift. No accounts. Includes Tesla Inc stock certificate. We are #1 in stock gifts. How can I purchase Tesla, Inc. shares in India? · Directly: By opening an international trading account with Angel One. The process would include KYC. How to trade Tesla (TSLA) Options on Public · Sign up and fund your account · Explore the Tesla Options Hub · Purchase Tesla options contracts · Earn up to $ View the real-time TSLA price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. To buy fractional shares of Tesla stock, you'll need to sign up for Stash and open a personal portfolio. Stash allows you to purchase smaller pieces of. Invest in Tesla, NASDAQ: TSLA Stock - View real-time TSLA price charts. Online commission-free investing in Tesla: buy or sell Tesla Stock commission-free. Step 1: Decide where to buy Tesla stock. You will need an online brokerage account in order to access the NASDAQ market and buy TSLA shares. One can easily invest in Tesla Inc shares from India by: Direct Investment - Opening an international trading account with Groww which includes KYC verification. Get Tesla stock quote in real-time, analyze price movement and start CFD trading using our advantages of tight spreads. Buy Tesla stock or sell it on IFC. What Is the Tesla Inc Stock Price Today? The Tesla Inc stock price today is What Is the Stock Symbol for Tesla Inc? The stock ticker symbol for Tesla. Conclusion: Is TSLA Stock a Good Buy or Sell? Tesla (TSLA) has an AI Score of -/10 () because, according to an overall analysis, it has a probability advantage. View Tesla, Inc. TSLA stock quote prices, financial information, real-time forecasts, and company news from CNN. Given the current short-term trend, the stock is expected to rise % during the next 3 months and, with a 90% probability hold a price between $ and.

Credit Card For Large Purchase

Financing a big purchase with a credit card can help you earn more rewards on it. Compare the best credit cards for large purchases to get started. IKEA Projekt card, special financing. IKEA Projekt credit card – for a large purchase. You don't have to pay for IKEA product purchases all at once. The IKEA. A credit card is likely your best bet for financing big purchases since you can earn rewards and benefit from an interest-free period. One of the best 0% APR. Get purchasing power, flexibility and security plus earn cash back on every purchase you make on the card. RBC offers credit cards for small, medium, or large. Large purchases don't need to be stressful. · Pay for eligible credit card purchases of $ or over by making monthly payments. · It's flexible and convenient. Credit cards typically offer all kinds of perks and benefits, including a one-time signing bonus for a new cardholder, cash back for purchases, rewards points. A large purchase credit card could help spread the cost of an expensive purchase, which might help make it a more manageable way to pay. Find Out How to Use Plan It® by American Express. Split Up Large Purchases Into Monthly Payments & Earn Rewards on all Amex Personal Cards. A Bank of Scotland large purchase credit card could help you spread the cost of more expensive purchases. Check your eligibility online today. Financing a big purchase with a credit card can help you earn more rewards on it. Compare the best credit cards for large purchases to get started. IKEA Projekt card, special financing. IKEA Projekt credit card – for a large purchase. You don't have to pay for IKEA product purchases all at once. The IKEA. A credit card is likely your best bet for financing big purchases since you can earn rewards and benefit from an interest-free period. One of the best 0% APR. Get purchasing power, flexibility and security plus earn cash back on every purchase you make on the card. RBC offers credit cards for small, medium, or large. Large purchases don't need to be stressful. · Pay for eligible credit card purchases of $ or over by making monthly payments. · It's flexible and convenient. Credit cards typically offer all kinds of perks and benefits, including a one-time signing bonus for a new cardholder, cash back for purchases, rewards points. A large purchase credit card could help spread the cost of an expensive purchase, which might help make it a more manageable way to pay. Find Out How to Use Plan It® by American Express. Split Up Large Purchases Into Monthly Payments & Earn Rewards on all Amex Personal Cards. A Bank of Scotland large purchase credit card could help you spread the cost of more expensive purchases. Check your eligibility online today.

Cash back rewards of % on all eligible net purchases. A net purchase is the amount of a purchase less any credits, returns and adjustments. Certain. credit card with a low interest rate. Most credit card payments have the added benefit of purchase protection, which can be beneficial when buying large. One of the most obvious benefits of a credit card is that you don't have to carry a lot of cash to make large purchases. Unfortunately, not all merchants accept. credit card. Explore lines of credit. Select Image. Loans. Whether you need help with unexpected expenses, a large purchase, or your next big goal, we have. Maxing it out depends on what your credit card limit is. Only put on your card what you can afford to pay off before the due date. You will find. IKEA Projekt card, special financing. IKEA Projekt credit card – for a large purchase. You don't have to pay for IKEA product purchases all at once. The IKEA. Can I know my plan fees and durations before making a large purchase? If you have an eligible Card with the Plan It feature, you can use the Plan It Pre-. With a high limit, you'll have the option to use this card for the purchase and maximize your rewards. As long as you pay your credit card balance in full and. Financing a big purchase with a credit card can help you earn more rewards on it. Compare the best credit cards for large purchases to get started. A credit card can be a great way to break large purchases into smaller, more manageable payments. However, carrying a credit card balance from month to month. Best travel credit cards · Bank of America® Premium Rewards® credit card: Quality rewards and several valuable perks give this card a nice value for the annual. Earning rewards, 35% ; Easiest/quickest option, 26% ; Avoiding credit card debt, 21% ; Can pay off over time, 10%. In this article, we will discuss some of the best cards for large purchases, how to choose the right credit card, and also the best ways to use your credit. Credit card use plays a huge role in contributing to your credit history purchase. There's no need to be shy when using your credit card responsibly. Best cashback credit cards ; UOB Absolute Cashback Card uob-absolute-cardface. Apply Now. % unlimited cashback. ⭐ Read our full UOB Absolute Cashback Credit. Chase credit cards can help you buy the things you need. Many of our cards offer rewards that can be redeemed for cash back or travel-related perks. With so. Credit cards tend to be a better choice for smaller purchases, but usually only if you can pay the balance off every month. Unlike lines of credit, you have a. By putting these large transactions on one credit card, you can keep your other card free and available for your regular daily purchases to stop yourself from. You might consider looking for credit cards with low introductory interest rates or rewards programs that align with your dream purchase. For example, some. This means that you treat your credit card as you would cash: use it to make regular purchases within your budget that you know you can afford. You don't treat.

Join The Marines At 30

To join the Air Force as an enlisted Airman, you must be between the ages of 17 and have not reached your 42nd birthday, a current US citizen and have obtained. 30 days of enlistment for certain in-demand jobs. This bonus can be combined with other enlistment bonuses to earn up to $50, Up to $45K. Job Signing. You'll need an age waiver if you're older than 28 years old. I've seen a few 30 yr olds enlist who weren't prior enlisted from other branches. Marine Corps Body Composition Standards. Age Group. Male. Female. 18% BF. 26% BF. 18% BF. 26% BF. 19% BF. 27% BF. 19% BF. 27% BF. am. —. —. —. —. —. Afternoon. —. —. —. —. —. —. —. Evening. —. —. —. —. —. —. —. Details Join the Military · DoD Careers · Privacy & Security · Web. Coast Guard enlisted members on flight deck. Why Join. Coast Guard member 30 Days Paid Vacation. Icon of barbell. World-Class Training/ Experience. The maximum age for enlistment is 35, but if you want to go in at 30 - anyone over the age of 28 has to request an age waiver. Login Join Donate. icon-search. logo. Home · About Us · Leadership · Board of October 30, / to Tampa Museum of Art. Learn more Register. Discover the military requirements needed and how to join the military. Learn what it takes to meet the criteria and embark on a fulfilling career in the. To join the Air Force as an enlisted Airman, you must be between the ages of 17 and have not reached your 42nd birthday, a current US citizen and have obtained. 30 days of enlistment for certain in-demand jobs. This bonus can be combined with other enlistment bonuses to earn up to $50, Up to $45K. Job Signing. You'll need an age waiver if you're older than 28 years old. I've seen a few 30 yr olds enlist who weren't prior enlisted from other branches. Marine Corps Body Composition Standards. Age Group. Male. Female. 18% BF. 26% BF. 18% BF. 26% BF. 19% BF. 27% BF. 19% BF. 27% BF. am. —. —. —. —. —. Afternoon. —. —. —. —. —. —. —. Evening. —. —. —. —. —. —. —. Details Join the Military · DoD Careers · Privacy & Security · Web. Coast Guard enlisted members on flight deck. Why Join. Coast Guard member 30 Days Paid Vacation. Icon of barbell. World-Class Training/ Experience. The maximum age for enlistment is 35, but if you want to go in at 30 - anyone over the age of 28 has to request an age waiver. Login Join Donate. icon-search. logo. Home · About Us · Leadership · Board of October 30, / to Tampa Museum of Art. Learn more Register. Discover the military requirements needed and how to join the military. Learn what it takes to meet the criteria and embark on a fulfilling career in the.

Determine Military career with a service enlistment counselor; Oath of Enlistment · Basic Training. Benefits of Joining the Military. 30 days of paid vacation. To join the Coast Guard, you must be a U.S. citizen or resident alien between 17 and 42 years old. While GEDs are sometimes accepted, high school diplomas are. Continue to contribute to their TSP, with 5% FBI match. Medical Leave. Disabled veterans rated 30% or more can receive a one-time benefit of up to hours of. Eligibility. Join Today Stripes. To qualify for membership in the VFW you MUST - Service in Korea for 30 consecutive or 60 non-consecutive days. *This. To commission as a Marine Officer, you must be a United States citizen between 20 and 28 and have obtained both a high school diploma and a bachelor's degree. If you are a veteran joining CBP, you will find many others that share your military background and principles. Join the Military | DoD Web Policies | No FEAR Act | DoD Resources | DoD FOIA | SOUTHCOM FOIA | Plain Writing Act · Hosted by Defense Media Activity - bitcoinwealth.site military can apply to join the ADF note 2: women have served in all roles for voluntary military service for men and women ( for. Retirement After 30 Years of Service. Upon completion of NOTE: Service as an appointed or enlisted aviation cadet in the Navy Reserve or Marine Corps. 30 June blanket expiration date. Can an industry partner participate in the SkillBridge program if they are not located near a military installation? 2nd Battalion, 7th Marines Tests Scout Platoon Capabilities for IBX Marine Littoral Regiment concludes historic exercise, set to join Stand-in. Prior Service enlistees who do not require military specialty training may not receive payment earlier than 30 days after arrival at the first perrnanent duty. 30 – 45 days. It also varies on the job assignment and Military Occupational Specialty (MOS). For Army Officers, the time to join depends on the path you choose. Military Personnel. 6. CHAPTER 2: ACTIVE DUTY MEMBERS. 9. Active Duty Personnel. Gender. Race/Ethnicity. Geographic Location. Age. Education. Determine Military career with a service enlistment counselor; Oath of Enlistment · Basic Training. Benefits of Joining the Military. 30 days of paid vacation. 30 AM – Peatross Parade Deck Friday Morning Colors Ceremony: AM Trial By Water U.S. Marines assigned to Marine Corps Recruit Depot Parris. Guests are allowed into the MEPS facility 30 minutes prior to a ceremony, and must depart within 30 minutes of its completion. Join the Military · DoD Careers. Returns. day refund/replacement ; Publisher, Gareth Stevens Pub (July 30, ) ; Language, English ; Paperback, 32 pages ; ISBN, What are the guidelines USERRA provides for the employee to return to work after completion of military service? ; days of service, Report next scheduled. JUN CO A, 1STBN, 8THMAR, 2NDMARDIV, FMF, MARIANAS ISLANDS. DOW. TAB A-AB Navy and Marines. The exercise was designed to signal that the U.S. is.

What Is The Difference Of S Corp And C Corp

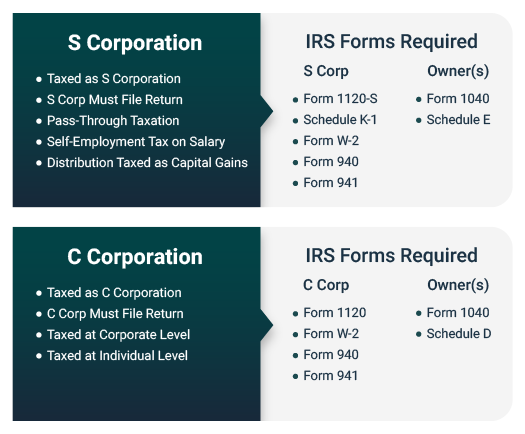

The S corporation is subject to the taxing provisions in much the same manner as a partnership. The S corporation files an information tax return, Form S. S corporations may be better suited for smaller-sized businesses, since they can have no more than shareholders participating as owners of the company. C. The difference between an S and a C corp involves the way they pay taxes under the Internal Revenue Code. A C corp files its own income tax return and pays. But, unlike a c corp, s corps only have to file taxes yearly and they are not subject to double taxation. Read on if this sounds enticing for. The Key Difference: Taxation. The biggest difference between C-corps and S-corps is how they are taxed. C-corps are subject to double taxation. Here. The difference between S Corp and C Corp lies in their formation process, taxation rules, ownership structure, and stock functionality. Any gains or profits made by the business are distributed to the shareholders to be taxed twice, resulting in double taxation. C Corps are unable to pass losses. Difference 3. Ownership. A C-corporation will give you more options when it comes to selling stock. According to the IRS, a corporation that chooses S. The 'C' in C Corporation stands for the subchapter of the IRS code which governs the federal taxation of the entity. This structure is much more traditional. The S corporation is subject to the taxing provisions in much the same manner as a partnership. The S corporation files an information tax return, Form S. S corporations may be better suited for smaller-sized businesses, since they can have no more than shareholders participating as owners of the company. C. The difference between an S and a C corp involves the way they pay taxes under the Internal Revenue Code. A C corp files its own income tax return and pays. But, unlike a c corp, s corps only have to file taxes yearly and they are not subject to double taxation. Read on if this sounds enticing for. The Key Difference: Taxation. The biggest difference between C-corps and S-corps is how they are taxed. C-corps are subject to double taxation. Here. The difference between S Corp and C Corp lies in their formation process, taxation rules, ownership structure, and stock functionality. Any gains or profits made by the business are distributed to the shareholders to be taxed twice, resulting in double taxation. C Corps are unable to pass losses. Difference 3. Ownership. A C-corporation will give you more options when it comes to selling stock. According to the IRS, a corporation that chooses S. The 'C' in C Corporation stands for the subchapter of the IRS code which governs the federal taxation of the entity. This structure is much more traditional.

C corporations and S corporations are different tax designations available to corporations. Each has its pros and cons, and the best choice for you will depend. The main difference between a C corporation and an S corporation is the taxation structure. S corporations only pay one level of taxation: at the shareholder. S Corporation vs C Corporation vs LLC ; Advantages, If you qualify then this is recommended. Cheaper to set up than LLC Cheaper annual report fee. Better tax. S and C corporations refer to businesses that incorporate in order to guarantee limited personal liability. The S and C letters stand for the tax status: an. The main difference between an S Corp and a C Corp is how they're taxed. C Corp status business owners pay taxes twice — at the corporate and individual level. The main difference between a C and S Corporation is that C Corporations face double taxation and are separate entities, whereas one of the benefits of S Corp. The following article explains the points of differences and the similarities between both, whereas the choice for the same depends on the goals of the. Unless the owner filed an S election, most corporations are C corporations by default. These companies are taxed on their own income at the current corporate. The key difference between an S corporation and a C corporation is how they are taxed. C corporations are subject to double taxation. The S-corporation is a vehicle that many business owners use to reduce the amount they contribute to Social Security and Medicaid. AC corporation (or C corp) is a legal structure for a corporation in which the owners, or shareholders, are taxed separately from the entity. This article provides a basic summary of the tax differences between C corporations and S corporations. Each has unique tax implications that can significantly. Both corporation formats are governed by similar provisions regarding ownership and capital generation. They are separate legal entities that provide limited. Although S corporations cannot convert to LLC/tax partnership form on a tax-free basis, they can become C corporations without tax simply by revoking their S. AC corporation becomes an S corporation only when, with the consent of all shareholders, special tax treatment (“pass-through taxation”) is sought. An S corporation, sometimes called an S corp, is a special type of corporation that's designed to avoid the double taxation drawback of regular C corps. S corps. The main differences between a C corp and an S corp are how they are formed, the ownership restrictions, and how they pay taxes. If you register a business as an S corporation, you'll be restricted to shareholders. The owners also must be non-profits, estates, trusts, or individuals. S corporations enjoy the same benefits and must observe the same formalities required of C corporations but are not subject to double taxation. S corps provide. S corporations and C corporations are more alike than they are different. The important difference: S corp vs C corp tax advantages. Setting up an S.